Several Japanese stocks are expected to grow in the future.

In this article, I will introduce five types of stocks that are expected to grow in the future.

Toyota Motor Corporation

The Toyota Group’s overall global sales volume will be approximately 9.52 million units in 2020, ranking first. Toyota is the largest company in Japan with a market capitalization of 30 trillion yen ($272 billion). The dividend yield is about 3%.

Over the long term, the stock price has been rising steadily. Since Toyota is an auto stock, it shows that it is sensitive to the economy and economic trends. The stock price rose from around 3,500 yen at the end of 2012 to over 8,000 yen by around 2015. The stock price then fell in the wake of the China Shock in 2015. Although it recovered temporarily, the stock price has been on a downward trend since the end of 2018 due to concerns about the slowdown of the Chinese economy caused by the US-China trade friction. Subsequently, the stock price fell due to COVID-19 and semiconductor supply shortages but reached a new high since listing in June 2021. Toyota has set a goal of selling 8 million electric vehicles by 2030, and its stock price has been rising due in part to this goal.

Lasertec Corporation

I remember this company well because I came across it when I was looking for a job. The HR manager was confident. When we talked to him, we found out that he was in his 30s and earning a high annual income of 15 million yen ($136,307). This salary is unthinkable in the Japanese manufacturing industry. With this in mind, I did a lot of research on this company.

Lasertec develops, manufactures, sells, and services semiconductor-related equipment, energy and environment-related equipment, FPD-related equipment, and laser microscopes. The company has a 100% share of the global market for mask blank inspection systems. Mask inspection systems have a high market value as equipment required for essential processes in semiconductor manufacturing. With the recent shortage of semiconductors, the demand for this equipment will increase. In June 2021, the stock price reached its highest level since it was listed. The shortage of semiconductors is expected to continue, so it is not too late to buy one now.

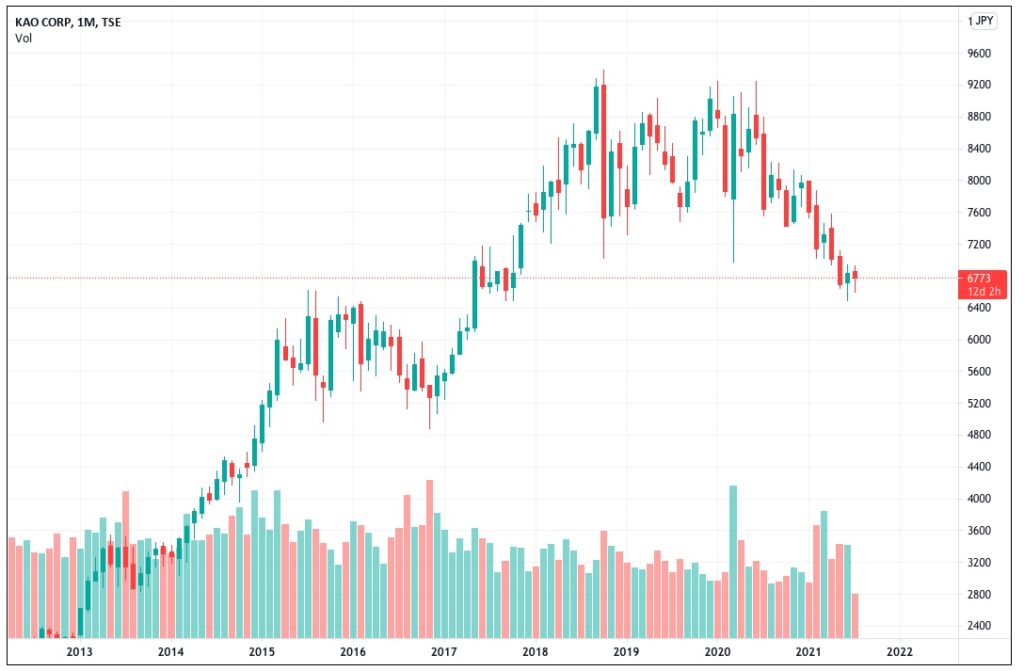

Kao Corporation

Kao is a leading manufacturer of toiletries and other fabric and home care products in Japan. Kao is also involved in cosmetics, healthcare products, and professional chemicals. As people’s lifestyles and values change, we are contributing to the realization of comfortable lives for people around the world by providing cleanliness and hygiene products that everyone can live with peace of mind. Sales in Japan have been somewhat sluggish, but overseas sales (Asia and America) have been growing. Daily necessities such as shampoos and detergents handled by Kao have a unique business feature in that they require less research and development costs than manufacturing products such as automobiles and computers.

The main ingredients of shampoos and detergents have not changed for decades, and there is no need for major improvements. Kao is in a very advantageous position to do business in daily necessities, where it does not have to spend huge R&D costs as pharmaceutical companies do. The company has increased its dividend for 30 consecutive fiscal years. The dividend yield is about 2%. Although the stock price is currently on a downward trend, I believe that now is the time to buy.

AEON Co., Ltd.

AEON operates general merchandise stores (GMS), supermarkets, convenience stores, and other general retail businesses throughout Japan.

The company also operates specialty stores selling women’s clothing and casual family fashions, commercial facility development, financial services, amusement, and food services. AEON has a shareholder special benefit plan. You can earn 3% cashback on most purchases. Some products offer discounts of 3-10%. If you live in Japan and shop at Aeon regularly, you can save a lot of money. However, the PER is 121x, making it a very expensive stock. So, if you don’t shop at Aeon, this is not the stock for you. The vesting dates for AEON shareholder rights are the last day of August and the last day of February, so it is relatively easy to buy in March and September because the stock prices are low.

Verite Co., Ltd.

Verite is a pioneer jewelry chain and a leading retailer of jewelry and watches in Japan. Although it has a subsidiary in India, it operates and retails several brands in Japan. Verite has a dividend yield of 8.85%. This is the highest dividend yield of any Japanese stock. (July 16th, 2021) The reason why dividends are so high is that they want to pay money to the parent company. Verite is now a subsidiary of Jewelsource Japan, and since the parent company owns about 60% of Verite shares, 60% of the profits will be paid to the parent company.

Verite’s performance is good and not that bad. Its capital adequacy ratio is about 70%, which means that its management is stable. In addition, the company is not in the red; it posts a profit of about 20 yen per share every year. What worries me is that the dividends are too high, and I also wonder if the management and the business will be stable in the future. Furthermore, the annual income of this company is quite low, around 3.5 million yen, so I am also concerned about whether the employees are satisfied with their work. I think this stock is suitable for short-term holding.

Comments