There is “compulsory liability insurance,” which is compulsory to join in Japan, and “voluntary insurance,” which you can decide to join or not join at your own will. Since there are many cases where liability insurance alone is not enough to cover you in case of an accident, it’s recommended to join the voluntary insurance. In this article, I will explain car insurance in Japan.

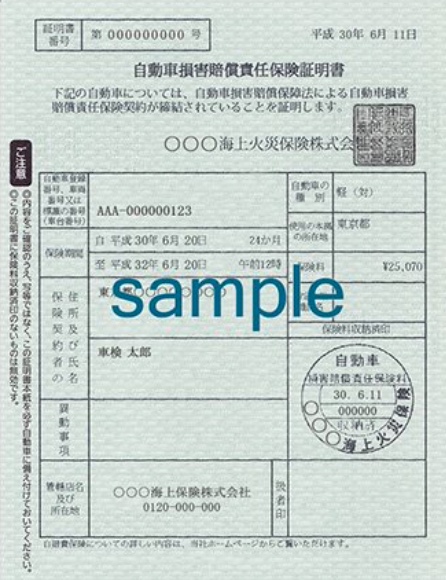

What is Compulsory Automobile Liability Insurance?

Have you ever noticed that you always pay for”compulsory automobile liability insurance premium” when you buy a car or have it inspected? There is one CALI policy for each car. You are automatically and without fail obliged to sign up for it (You are obliged and automatically sign for it). Why is it compulsory to purchase CALI? It is because the purpose of CALI is to help victims (to be insured in unprecedented events.)

If you drive on a public road with expired liability insurance, you will not only be imprisoned for not more than one year or fined not more than 500,000 yen but you will also be given six points for violations and your license will be suspended.

Even if the certificate has not expired, driving without it (,) will result in a fine of up to 300,000 yen.

The amount of compensation paid is up to 1.2 million yen in case of injury, up to 30 million yen in case of death, and up to 40 million yen in case of permanent disability.

As shown by this amount, it is not enough. If you kill someone with your car, the compensation is often in the hundreds of millions of yen. Therefore, it is better to take out voluntary insurance.

Where to buy car insurance?

Dealership (agency type)

Advantages

If you purchase automobile insurance through a dealer, the dealer will act as your insurance agent, making it a one-stop shop for contract procedures and procedures in the event of an accident. In the event of an accident, you can contact the dealer for both insurance and repairs, so you don’t have to contact many places under the unusual circumstances of an accident.

Although not all dealers offer this service, you may be able to purchase an auto insurance policy that includes services unique to the manufacturer. The details vary from manufacturer to manufacturer, but it is possible to get compensation for repairing minor damages to your vehicle without using your vehicle insurance.

Disadvantages

Since contracting with a dealer is an agency type of car insurance, the premiums are often higher than those for internet car insurance. Also, there is no group discount, so it is more expensive if you will purchase insurance as a group at work. If you are thinking about insurance premiums, it is better to consider a direct type of car insurance instead of purchasing car insurance directly from a dealer.

Also, the person in charge at the dealership does not necessarily have a deep understanding of auto insurance. Of course, some of them are very knowledgeable, but some of them are not able to answer some in-depth questions. If the person in charge is uneducated, there is a possibility that you will not be able to make an appropriate contract. It is important to understand the contents of the insurance policy yourself, rather than leaving everything to the person in charge.

Internet (mail order type)

Advantages

The biggest advantage of Internet-based car insurance is the low premiums. If you enter the same conditions for both Internet-based and store-based auto insurance and get a quote, internet-based auto insurance will always be cheaper.

Since there is no need for agents and no need for mailing documents, there is no need for labor and company expenses. Internet-based car insurance is cheaper than agent-based car insurance because of cost-cutting.

In addition, Internet-based auto insurance offers a discount system called Internet Discount. You can enroll and renew your insurance over the phone, but if you enroll over the Internet, you can get a discount of about 10,000 yen. Internet-based auto insurance is the best way to save money. In addition, it is convenient that you can join 24 hours a day at any time you want.

Disadvantages

The disadvantage of online car insurance is that you have to complete all the procedures by yourself. You have to think and do everything yourself, from purchasing the insurance to continuing it and changing the coverage. If you buy a new car, change your address or age, or want to expand the range of people who can drive, you have to make the changes yourself.

With agent-based car insurance, you can simply contact the agent in charge and let them handle the change, but this is not the case with Internet-based car insurance. If you are not able to manage your insurance or do not want to take the time to go through the process, we do not recommend internet-based auto insurance. You may end up paying unnecessary premiums because your age group is still the same as when you were in your 20s, even though the insured person is now over 35.

Basic auto insurance coverage

The following is a list of basic coverage. In addition, there are various other coverage contents for each company, so I will introduce the seven basic contents this time. As a matter of course, the better the coverage, the higher the monthly insurance payment will be.

Bodily injury liability insurance

Bodily injury liability insurance covers damages caused by an automobile accident that results in the death or injury of another person and for which you are legally liable. The insurance pays out up to the amount of insurance over the limit paid by the compulsory liability insurance that all automobiles are required to have by law.

In general, it is recommended to set this insurance to unlimited.

Property damage liability insurance

Property damage liability insurance covers you if you are legally liable for damages caused by an accident involving your car that destroys the other party’s car, building, property, or other objects. If the other person’s car is a luxury car, or if you damage a trailer carrying expensive goods, you may have to pay tens of millions of yen.

It is best to set this coverage to unlimited as well.

Personal Accident Compensation Insurance

Personal Accident Compensation Insurance is an insurance policy that compensates for the medical expenses for injuries to you and your passengers caused by an automobile accident, lost earnings and nursing fees due to residual disabilities, psychological damages, and income while you are unable to work, without reduction due to offsetting negligence. You can receive the insurance money without waiting for the end of settlement negotiations with the other party to the accident.

This is good for about 30 million yen.

Passenger Accident Insurance

Passenger Accident Insurance is an insurance policy that compensates for damages incurred when a person riding in a car (including the driver) is injured in a traffic accident. All people on board are eligible for compensation.

In my opinion, it is necessary and more beneficial if you have a family and not necessary if you are single.

Self-Injury Insurance

Self-inflicted accident insurance is insurance policies that compensates for accidents that occur while driving, in which the driver or passengers are killed, injured, or suffer permanent disability or bodily injury, and in which the liability insurance does not pay.

This is the minimum amount of coverage that you need. This is because if the accident is so severe that your passenger is killed, it is highly likely that you are also killed.

Uninsured Motorist Accident Insurance

Uninsured Motorist Accident Insurance provides coverage in the event of death or permanent disability of the insured due to an accident with a car that is not covered by voluntary automobile insurance, and the other party is unable to receive sufficient compensation due to inability to pay or other reasons.

In my opinion, it is not necessary to take out this insurance. First of all, the Non-life Insurance Premium Rate Calculation Corporation has announced that the percentage of cars without voluntary automobile insurance is about 25%. However, this figure includes cars owned by companies, so the actual percentage is about 10%. Therefore, it is not necessary.

Vehicle Insurance

Vehicle insurance is insurance that covers the cost of repairing your car. In addition to traffic accidents, it also pays for damage caused by theft or natural disasters (except but not as limited to for earthquakes, eruptions, and tsunamis).

In my opinion, you should get insurance for a new car, but not for a used car. However, be aware that even for new cars, the monthly payment for a sports car with a high accident rate will be very high.

How to choose an insurance company

If you are not that familiar with insurance, or if you want to leave the other insurance to them, I recommend you to go with an agency type. They will be able to help you directly with the paperworks for renewal, accidents, etc., so they will be reassuring in that respect as well.

If you want to save money and purchase insurance over the Internet, I recommend a website that offers bulk quotes. If you decide on the coverage you want and do a batch quote, you can compare rates and decide easily.

One Day Auto Insurance

One-day auto insurance is an ultra-short-term auto insurance policy that can be purchased in 24-hour increments at a convenience store near you. The insurance period is 24 hours, and the estimated premium per day is about 500 yen. If you add vehicle insurance, the premium will be about 1,000 yen more. This insurance is very convenient for those who have a car license and drive occasionally or borrow a friend’s car to drive. When I was a student, I often used this insurance when I borrowed my parents’ car to ride.

Comments