In Japan, there are a variety of payment methods. However, Japan slow to move to cashless payments. The usage rate of cashless payment in 2020 will be 29.7%. This figure is the highest in Japan, but lower than in other countries. There are many reasons for the lack of progress in going cashless, but one of them is that there are too many payment methods. In this article, I will introduce the payment methods available in Japan.

Card Type

VISA, MasterCard, JCB and American Express are accepted at many stores in Japan. Now that American Express has formed a business alliance with JCB, JCB cards can be used at participating stores. Please note that Diners Card and China Unionpay are not accepted at many stores.

Credit Cards

- ANNUAL FEE free~385,000 yen ($3490)

- REWARDS RATE 0.2%~3.0%

A credit card is a card that can be paid later. Credit cards can be used in many places, including convenience stores, supermarkets, online shopping, and payment of utility bills and taxes. There are many types of credit cards. I recommend a credit card with no annual fee. Some credit cards with no annual fee rewards rate of 2% or more.

Debit Cards

- ANNUAL FEE free

- REWARDS RATE 0.2%~2.0%

A debit card is a card that deducts money from your bank account when you use it. Unlike credit cards, you cannot use them unless you have a balance in your bank. It is easy to get approved for card issuance.

Prepaid Cards

- ANNUAL FEE free

- REWARDS RATE 0.0%~1.0%

A prepaid card is a card that allows you to charge cash to the card in advance, and within that range, you can use it at merchants such as VISA and Master card just like a credit card. Anyone can get a prepaid card.

Electronic Money Type

There are two types of electronic money: Credit Card Linking type and Prepaid type. These have become dramatically more convenient with the advent of apple pay and google pay. With the advent of these, it is now possible to make payments using smartphones. Note that it only works with FeliCa-equipped phones.

Apple Pay, Google Pay

Apple Pay and google pay are systems that allow you to use electronic money on your smartphone. Thanks to these two, you’ll be able to use electronic money such as iD, QUICPay, and Suica on your smartphone.

Credit Card Linking Type

iD

- ANNUAL FEE free

- REWARDS RATE 0.0%~3.0%

iD is a contactless payment service operated by NTT Docomo. The reward rate will vary depending on the card you connect.

QUICPay

- ANNUAL FEE free

- REWARDS RATE 0.0%~3.0%

QUICPay is a contactless payment service operated by JCB. Basically, it is the same as iD, and the number of stores where you can use it remains the same.

VISA Touch

- ANNUAL FEE free

- REWARDS RATE 0.0%~3.0%

VISA Touch is a contactless payment service operated by VISA. VISA Touch is not available at many stores yet. They are running a lot of campaigns to increase the number of users.

Deposit Type1

nanaco

- ANNUAL FEE free (Issuance fee: 300 yen)

- REWARDS RATE 0.0%~0.5%

Nanaco is a contactless payment service operated by Seven & i Holdings Co., Ltd. There are a limited number of stores where nanaco can be used. However, nanaco can be used to pay taxes at Seven-Eleven. If you pay your taxes by credit card, you will be charged a fee. There is no fee for paying taxes with nanaco charged with a credit card. You will also receive rewards based on the amount you charge. That’s why I pay my taxes with nanaco.

Rakuten Edy

- ANNUAL FEE free

- REWARDS RATE 0.5%~1.5%

Rakuten Edy is a contactless payment service operated by Rakuten. Rakuten Edy can be used at some stores. It allows you to apply Rakuten points to your payment. Rakuten points are easy to earn, so I often use Rakuten Edy as well.

WAON

- ANNUAL FEE free (Issuance fee: 300 yen)

- REWARDS RATE 0.5%

WAON is a contactless payment service operated by AEON RETAIL Co., Ltd. The number of stores that accept WAON is limited. To be honest, there’s not much benefit to using it.

Deposit Type2 (Transportation)

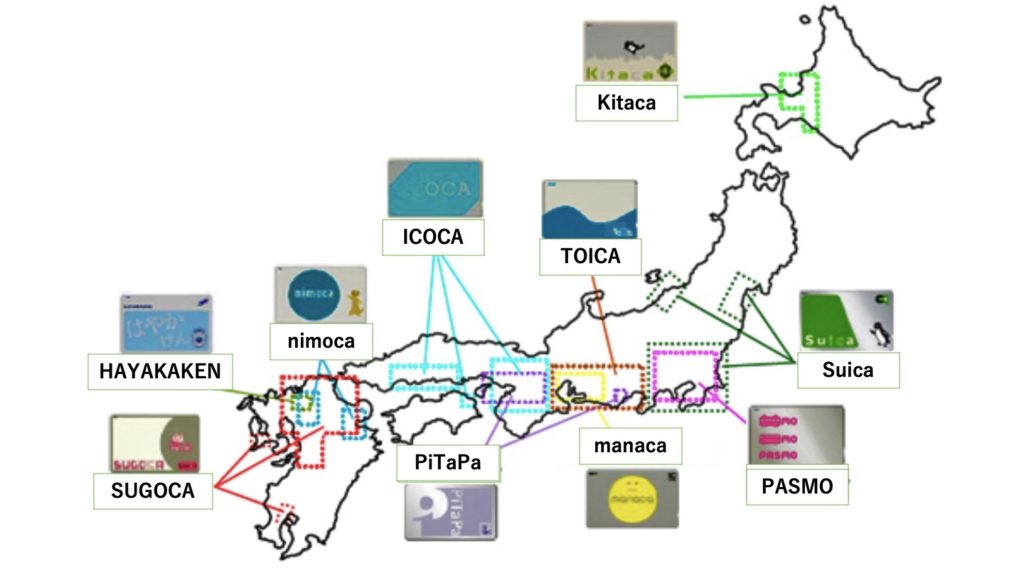

The nationwide mutual use service for transportation e-money is a service that coordinates the mutual use of each type of e-money in each region.

Suica

- Issue: JR-EAST

- Mobile Support: ○

- Charge from credit card: ○

Kitaca

- Issue: JR-HOKKAIDO

- Mobile Support: ×

- Charge from credit card: ○

PASMO

- Issue: Pasmo Co.,Ltd.

- Mobile Support: ×

- Charge from credit card: ○

TOICA

- Issue: JR-TOKAI

- Mobile Support: ×

- Charge from credit card: ×

manaca

- Issue: Nagoya Transportation Development Organization Co., Ltd.

- Mobile Support: ×

- Charge from credit card: ○

PiTaPa

- Issue: Surutto KANSAI Co., Ltd.

- Mobile Support: ×

- Charge from credit card: ×

ICOCA

- Issue: JR-WEST

- Mobile Support: ×

- Charge from credit card: ○

nimoca

- Issue: Nimoca Co., Ltd.

- Mobile Support: ×

- Charge from credit card: ○

SUGOCA

- Issue: JR-KYUSHU

- Mobile Support: ×

- Charge from credit card: ○

HAYAKAKEN

- Issue: Fukuoka City Transportation Bureau

- Mobile Support: ×

- Charge from credit card: ×

QR Payment Type

PayPay

- ANNUAL FEE free

- REWARDS RATE 0.5%~1.5%

This is the most popular QR payment type in Japan. For more details, please see the previous article.

Line Pay

- ANNUAL FEE free

- REWARDS RATE 0.0%~2.0%

LINE Pay used to compete with PAYPAY and ran various campaigns to attract customers. However, since the joint venture between PAYPAY and LINE Pay, the number of campaigns has decreased. Recently, they have been distributing monthly coupons that can be used at large chain stores, and I sometimes use them.

d-barai

- ANNUAL FEE free

- REWARDS RATE 0.5%~1.0%

D-barai is provided by NTT-docomo. D-barai often runs 5-20% rewards campaigns to attract customers. I only use it during campaigns.

au PAY

- ANNUAL FEE free

- REWARDS RATE 0.0%~0.5%

Au Pay is a QR payment service operated by KDDI Corporation. Au Pay also focuses on customer acquisition and often offers 5-10% rewards campaigns.

Rakuten Pay

- ANNUAL FEE free

- REWARDS RATE 0.0%~1.5%

Rakuten Pay is provided by Rakuten. Rakuten Pay doesn’t run many campaigns. I use it when I want to spend my Rakuten points.

MeruPay

- ANNUAL FEE free

- REWARDS RATE 0.0%

MeruPay is provided by Mercari. Mercari, a major flea market app in Japan. You can charge your Mercari sales proceeds to MeruPay. MeruPay also distributes a variety of coupons.

FamiPay

- ANNUAL FEE free

- REWARDS RATE 0.0%~0.5%

FamiPay is provided by FamilyMart Co.,Ltd. Famipay is not yet available in many stores. If you buy a 100 yen amazon gift certificate at a convenience store and pay with FamiPay at FamilyMart, you will receive 10 points. This means that you can purchase amazon gift certificates at a 10% discount. This is not recommended because it will cause trouble for the convenience store clerks.

J-Coin Pay

- ANNUAL FEE free

- REWARDS RATE 0.0%

J-Coin Pay is provided by Mizuho Financial Group, Inc. J-Coin Pay sometimes offers a 5% rewards on campaigns, but there are few stores where you can use it. I don’t use it much.

Yucho pay

- ANNUAL FEE free

- REWARDS RATE 0.0%

Yucho pay is provided by Japan Post Bank Co., Ltd. The provider is a very large company, but there are no campaigns and few stores available. I’ve never used one.

Amazon Pay

- ANNUAL FEE free

- REWARDS RATE 0.0%~2.0%

Amazon Pay is provided by Amazon. I’ve never seen a store that accepts Amazon Pay. I did some research and found that the number of stores where I could use it was very limited.

QUO card Pay

- ANNUAL FEE free

- REWARDS RATE 0.0%

Quo card pay is often distributed in sweepstakes. Basically, it is used to send a gift to someone. It can be used in convenience stores, so it’s not bad.

Alipay, Wechat Pay

Alipay and Wechat Pay are Chinese QR payment methods that can be used in Japan. Chinese tourists often use these. Japanese can also register, but I haven’t because I don’t plan to go to China.

Comments