When a foreigner wants to apply for a credit card in Japan, he or she will need a “Residence Card” or “Special Permanent Resident Certificate”. A resident card can be issued if you have been in Japan for more than three months. Foreigners living in Japan may have trouble to decide which of the many types of credit cards to get. So, in this article, I, who have more than 30 credit cards, I am going to introduce 5 credit cards that I recommend.

VISA LINE PAY Card

- Point rate: 2%

- Issuing Company:Sumitomo Mitsui Card Co., Ltd

- International Brand: VISA

- Annual fee: 1,375 yen (free if you use the card at least once a year)

- Screening: Standard

One of the most attractive features of the Visa LINE Pay Credit Card is that you can earn 2% LINE Points for shopping anytime, anywhere.

The annual fee is waived for the first year and ¥1,375 for the following years, but if you use the card for shopping at least once in a year, the annual fee is waived.

The Visa LINE Pay Credit Card can also be linked to the chat application LINE, which is used by all Japanese people, and one of the advantages of the Visa LINE Pay Credit Card is the instant LINE notification service for card usage.

You will receive instant LINE notifications of your Visa LINE Pay Credit Card usage, which will help you avoid overspending it. Especially for beginners who are not yet familiar with credit cards, it is great to be able to check your usage status in real time.

You can also convert the LINE points you earn here into PAYPAY points, which is a great way to invest tax-free. For more details, please refer to the following article.

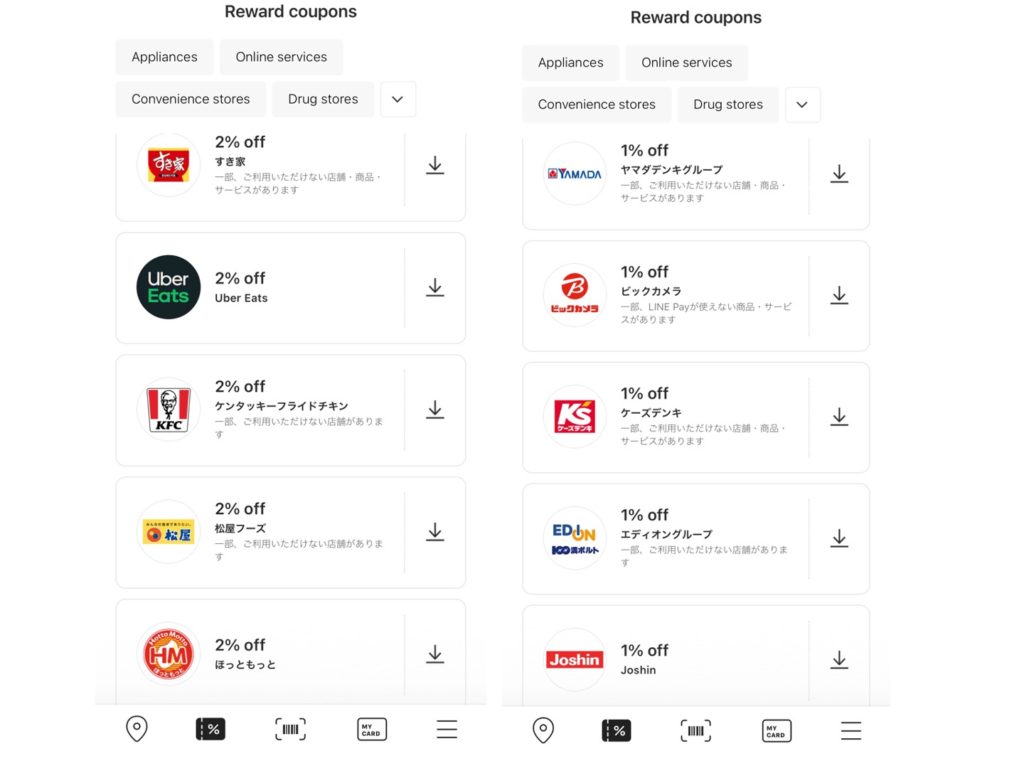

The Visa LINE Pay Credit Card offers a unique benefit in the form of rewards coupons which can be used with LINE Pay (QR payment).

The rewards coupon can be used at over 100 of the most popular LINE Pay merchants. They can be used for code payments and online payments.

They can be used at various stores such as convenience stores, supermarkets, mass merchandisers, and restaurants.

Rakuten Card

- Point rate: 1%

- Issuing Company: Rakuten Card, Co., Ltd

- International Brands: JCB, VISA, Mastercard, AMEX

- Annual fee: free

- Screening: Easy

Rakuten Card is the most popular credit card in Japan. Rakuten Card is the most popular credit card in Japan because of its easy application process, high Point rate, and the fact that Rakuten points can be used at various stores. Also, there is no annual fee. The first card I got was the Rakuten Card, and I still use it to these days. Also, if you use your Rakuten Card for various Rakuten services, your Point Rate will improve. You can also use your Rakuten Card to purchase up to 50,000 yen in mutual funds per month. Of course, you can earn 1% Rakuten points. For more details, please refer to the following article.

Rakuten Card can be used in combination with Rakuten Pay to earn double points, with a Point rate of 1.5% per 100 yen.

Epos Card

- Point rate: 0.5%

- Issuing Company: Epos Card Co., Ltd

- International Brand: VISA

- Annual Fee: Free

- Screening: Easy

The Epos card has no annual fee, and has a Point rate of 0.5%, which is lower than the other credit cards listed here, but if you shop at Marui (a department store), the rate is 1%. One good thing about the Epos card is that if you spend more than 500,000 yen per year, you will be issued a Gold Card invitation. Even if you don’t spend 500,000 yen per year, this Epos card also allows you to purchase mutual funds up to 50,000 yen per month, so you can get a Gold Card without using any shopping!

The advantage of this Gold Card is that the Point rate is up to 2.5%. If you have an eligible store near your house, this is definitely a card you should make.

Mitsui Sumitomo Card (NL)

- Point rate: 1%

- Issuing Company: Sumitomo Mitsui Card Co., Ltd

- International Brand: VISA, Mastercard

- Annual Fee: Free

- Screening: Easy

The biggest advantage of Sumitomo Mitsui Card is that it is easy to get approved even in foreign countries. You can find the following article on the official Q&A page to find out why.

The application and screening process is almost the same as for Japanese. As long as the applicant has the same repayment ability as Japanese applicants and the time between application and return to their home country is sufficient, even foreigners can get a credit card in Japan.

Quote: 外国人が日本でクレジットカードを作るにはどうすればよい?

It is rare that such an announcement is made on the official page, so foreigners can make a credit card with peace of mind. The biggest feature of this card is that it does not have a credit card number on it. You can check the number on the application. It is a card with excellent security.

Amazon MasterCard Gold

- Point rate: 1%

- Issuing Company: Sumitomo Mitsui Card Co., Ltd

- International Brand: Mastercard

- Annual fee: 11,000 yen (4,400 yen if you register for revolving payments and web statements)

- Screening: Difficult

This card comes with Amazon Prime, which means you can use Amazon’s free shipping and free express delivery. You can also watch unlimited movies, dramas, and anime on Amazon Prime Video. In addition, there are 13 other benefits. Normally, the annual fee for membership is 4,900 yen. However, if you register for revolving payments and web statements with the Amazon Gold Card, the annual fee will be 4400 yen. This is 500 yen cheaper than the normal membership fee. Also, if you set the revolving payment limit to the maximum amount of your credit card, you can make a lump-sum payment without incurring any fees.

If you want to subscribe to Amazon Prime, you should have this card. However, this card is very difficult to get, so it is suggested for advanced users.

Comments